Also forecasters at the Construction Products Association warn that any growth at all in the next two years will wholly rely on the pace of delivery of government infrastructure projects.

If spending on major infrastructure is slowed the industry faces a 1% fall in output in 2018.

Construction is expected to bounce back again to 2% growth in 2019 as infrastructure activity kicks into gear.

Major projects in rail and water & sewerage such as HS2 and the £4.2bn Thames Tideway Tunnel will lift infrastructure output by 25% in 2019.

Autumn CPA forecast

- Construction output to rise 0.7% in 2017, 0.0% in 2018 and 2.0% in 2019

- Private housing starts to rise 5.0% in 2017 and 2.0% in 2018

- Offices construction to decline 5.0% in 2017, 15.0% in 2018 and 5.0% in 2019

- Retail construction to fall 7.0% in 2017, 5.0% in 2018 and rise 2.0% in 2019

- Infrastructure work to rise by 7.4% in 2017, 6.4% in 2018 and 9.8% in 2019

House building will continue to be a primary driver of growth, with private housing starts rising by 5% in 2017 and 2% in 2018. With the government’s Help to Buy equity loan accounting for 40% of new homes the extra £10bn that government announced for the scheme in October will continue to sustain house building despite the slowdown in the general housing market.

Forecasters predict the sharpest decline will be in the commercial sector, particularly offices work as Brexit-induced wariness among investors has led to a sharp fall in contract awards.

Office construction will dive 15% next year, and is likely to accelerate if it proves to be the case that the UK will not be part of the Single Market and financial services firms transfer operations into other EU member states.

Noble Francis, Economics Director at the Construction Products Association said: “Construction activity is currently high, particularly in cities outside the capital such as Birmingham and Manchester.

“However, the forecasts highlight that the fall in construction new orders since the second half of 2016 is now starting to feed through to activity on the ground as projects signed up to pre-referendum end and are not being replaced.

“This is especially the case in key areas such as the construction of new commercial offices in London, where demand for new high profile office space from the financial sector has slowed considerably.

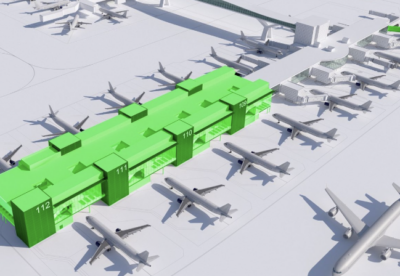

“Infrastructure is expected to be major driver of construction activity in the next few years with work on major projects but the sector has been dogged by constant cost overruns and delays.

“Given that construction activity is forecast to be flat in 2018, if government cannot improve delivery of its infrastructure plans, construction output is likely to decline next year.”

.gif)

.png)